How to Choose Which Value to Use in Relative Valuation

To compare valuations across companies the share price of each of them is divided by its projected EPS to obtain a forward-looking PE ratio. Supply Chain Analysis provides suppliers customers and competitors for companies.

The Right Role For Multiples In Valuation Mckinsey

Financial ratios growth rates etc with those of similar other assets to derive the price of the asset.

. Just go on Trade Brains Portal on the top menu bar select the Compare Stocks feature under Products. A very common and traditional ratio which is used to compare various equity stocks traded at exchanges is PE Price to Earnings Ratio. Relative valuation model is a business valuation method where companys market value is compared with its financial variablesIt is assumed that the market i.

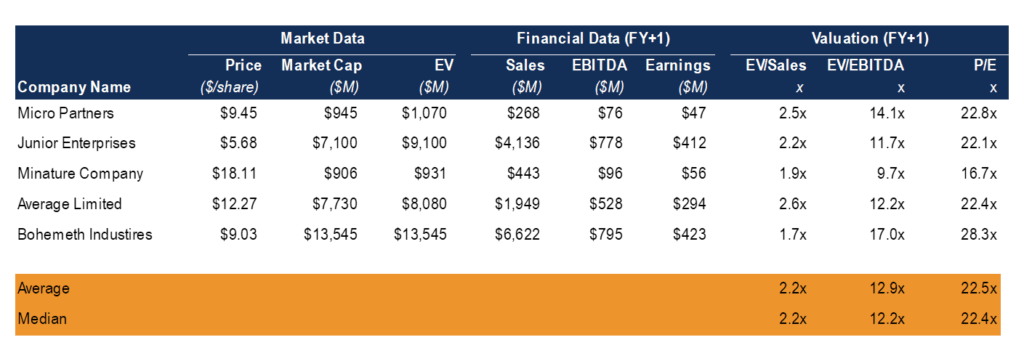

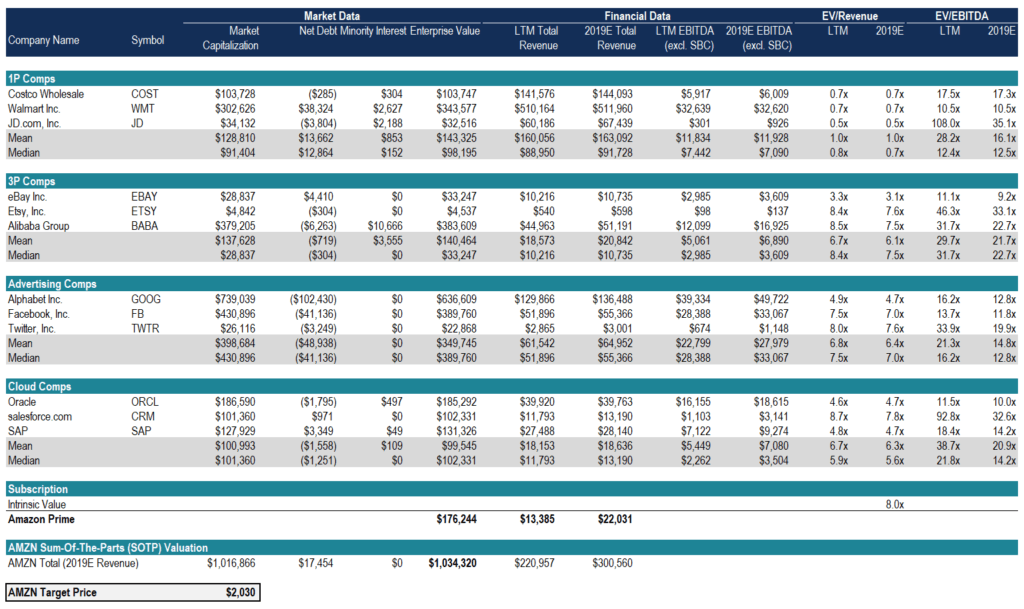

For instance consider the case when a conglomerate company makes an acquisition in an unrelated business. To do relative valuation then we need to identify comparable assets and obtain market values for these assets convert these market values into standardized values since the absolute prices cannot be compared This process of standardizing creates price multiples. Also called trading multiples or peer group analysis or equity comps or public market multiples is a relative valuation method in which you compare the current value of a business to other similar businesses by looking at trading multiples like PE EVEBITDA EBITDA Multiple The EBITDA multiple is a financial ratio that compares a companys Enterprise Value to its annual.

Book value per share is the net worth divided by the number of shares outstanding. To derive The Home Depots forward-looking PE of 133 for instance you would divide the companys weekend closing price of 33 by its projected 2005 EPS of 248. The equation looks like this.

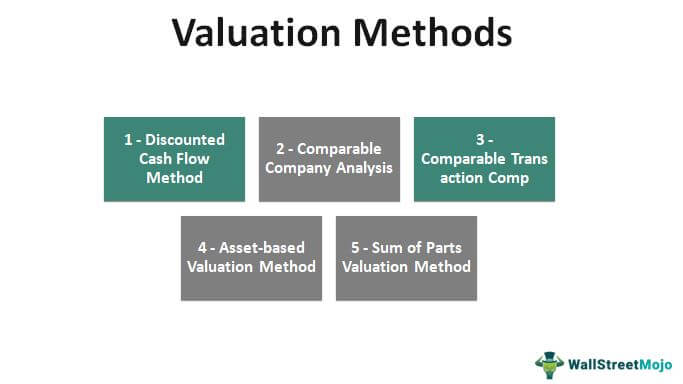

Relative valuation tries to calculate the value of a firm by comparing it with similar firms like those in the same industry and using the same metric. Relative Valuation is the process of comparing certain characteristics and parameters eg. Aswath Damodaran presents an approach for analyzing and using multiples eg price-to-earnings and enterprise-value-to-EBITDA multiples and comparable firms in valuation analysis.

Book value of a company is simply its net worth or equity. Cashflow for Year n x 1 r-n Where r is the discount rate and n is the number of years of the investment. Relative valuation is borne by financial markets.

Disadvantages of PB Ratio Book values like earnings are affected by. - Even firms with negative earnings which cannot be valued using PE ratios can be evaluated using price-book value ratios. Here is the result that you will get if you compare the top Tyre Companies in India.

Trade Brains Portal is a powerful website for stock research. To find the relative value for all three companies is to multiply that number by the current EBITDA per share which I will list below. Compare your company to competitors using Bloombergs peer list GICS industry or sub-industry lists or create your own unique peer list.

For example PE ratio could be used as the value multiple. The approach assumes that the. NIs the multiple uniformally estimated.

Verizon 1033 x 793 8192. The formula to calculate the fair value of a stock using Discounted Cash Flows Model is as follows. If you have more leeway and are trying to find under or overvalued.

If you want to stay narrowly focused on your sector and make judgments on which stocks are under or over valued you should stick with sector based relative valuation. - Relative valuation is built on the assumption that markets are correct in the aggregate but make mistakes on individual securities. Verizon 1033 TTM ATT 764 TTM TMUS 1450 TTM Now lets multiply each of these by the sector multiple and compare them to the current market price.

Price to book value PBV Price per share divided by Book value per share. Discounted Cash Flows Cashflow for Year 1 x 1 r-1 Cashflow for Year 2 x 1 r-2. He also explains how to examine a range of earnings book value and revenue multiples and discusses how to use multiples wisely and catch abuses when.

Relative valuation is much more likely to reflect the current mood. PE ratio price per share earnings per share Lets say a company is reporting basic or diluted earnings per share of 2 and the stock is selling for 20 per share. Enter the name of the companies and youll get the comparisons.

Lastly the purpose of investment also plays a major role in the valuation model being chosen. The basic theory goes as follow. Market value multiple for the comparable company is defined as the ratio of market value of comparable company and its value indicator.

Compare the standardized value or multiple for the asset being analyzed to the. The market value of a target firm market value multiple for the comparable company value indicator for target firm. Valuing using valueFCFF Industry average is 20 Firm has FCFF of 2500 Shares outstanding of 450 MV of debt 30000 Using ValueFCFF20 value FCFF20 MV equity MV debt FCFF20 MV equity FCFF20 MV debt Price FCFF20-MV debtShares Price 250020-30000450 4444 18.

The approach you use for relative valuation will depend again upon what your task is defined to be. Relative analysis provides peer group relative value analysis. In other words the value of equity should be divided by equity earnings or equity book value and firm value should be divided by firm earnings or book value.

Its easy to calculate as long as you know a given companys stock price and earnings per share EPS. Both the value the numerator and the standardizing variable the denominator should be to the same claimholders in the firm. Here the value derived by the investors will be directly related to the value of the assets themselves.

In a sense we are challenging investors who have a problem with a relative valuation to take it up with the market if they have a problem with the value.

Relative Valuation Methods Youtube

/GettyImages-1144149669-9fca5c1050ed4ce38d6269816633e95c.jpg)

How To Choose The Best Stock Valuation Method

Relative Valuation Overview Types And Example

Undervalued Stocks Dividend Investing Money Management Advice Investing

Valuation Methods Three Main Approaches To Value A Business

Pin By The Project Artist On Understanding Entrepreneurship Financial Statement Understanding Understanding Yourself

Asset Valuation Based Ranking Whitepaper Whitepaper Book Worth Reading Worth Reading

Session 18 Relative Valuation Analysis And Application Youtube

Valuation Methods Three Main Approaches To Value A Business

Session 18 Relative Valuation Analysis And Application Youtube

Valuation Methods Guide To Top 5 Equity Valuation Models

Advantages And Disadvantages Of Equity Valuation Investing Equity Accounting And Finance

Relative Value Valuation Overview And Examples

Relative Valuation Overview Types And Example

How To Do The Relative Valuation Of Stocks Basics Of Stock Valuation

Advantages And Disadvantages Of Equity Valuation Investing Equity Accounting And Finance

:max_bytes(150000):strip_icc()/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

Comments

Post a Comment